Banker acceptance double entrybanker acceptance double entry. A debit to one account and a credit to another.

June 29 2022.

. It does not deal with the accounting treatment of bankers acceptances by the drawer borrower. Any entity that intends to enter into a high-value transaction would get in touch with its banker for a bankers acceptance. The customer accepts the bill of exchange and the business transfers the asset to a bills receivable account.

Double-entry bookkeeping is an accounting system where every transaction is recorded in two accounts. Because of the bank guarantee a bankers acceptance is viewed as an obligation of the bank. Before acceptance the draft is not an obligation of the bank.

Journal entries in the books of consignor - Accounting For. You borrow 10000 from the bank. Banker acceptance double entryvanderbilt school of engineering acceptance rate.

For example if a business takes out a 5000 loan the cash asset account is debited to 5000 and the outstanding debt liability account is credited 5000. A bankers acceptance is a legally binding obligation by the accepting bank to pay the stated amount at the maturity date of the time draft. A bankers acceptance BA aka bill of exchange is a commercial bank draft requiring the bank to pay the holder of the instrument a specified amount on a specified date which is typically 90 days from the date of issue but can range from 1 to 180 days.

The bankers acceptance is issued at a discount and paid in full when it becomes due the difference between the value at maturity. The entity would need to provide the details about the transaction including the amount of credit required. B sends his promissory note for 3 months to C for Rs 6000 on May 1 2011.

Upon acceptance which occurs. On the due date the bill is dishonoured the bank paying Rs 10 as noting charges. The business sells goods to a customer and records the amount owed as an accounts receivable asset in the normal manner.

A short-term debt instrument issued by a company that is guaranteed by a Commercial Bank. This Technical Bulletin contains recommendations on the accounting treatment of bankers acceptances by a bank. C agrees to accept Rs 2130 in cash.

It can have maturity dates ranging from 30 to 180 days. When a contra entry posted in cash book there is a reference column the letter C is written this denotes that the entry is a contra entry. Paid acceptance to Bala Ram for Rs.

C gets it discounted with his bankers at 18 per cent annum on 4th May. A bankers acceptance or BA is a time draft drawn on and accepted by a bank. Their definitions are noted below.

The payment is accepted and guaranteed by the bank as a time draft to be drawn on a deposit. Thus you are incurring a liability in order to obtain cash. Finally the usual entry for acceptance of a fresh bill is passed.

The customer makes the payment to the business. There are three stages in the bills receivable accounting process. A bankers acceptance is a short-term debt instrument that helps to facilitate trade transactions between two parties when they do not have an established credit relationship.

If the bank has a good reputation the acceptance can be resold in an open market at a discount. Purchased equipment for 650000 in cash. A double entry accounting system requires a thorough understanding of debits and credits.

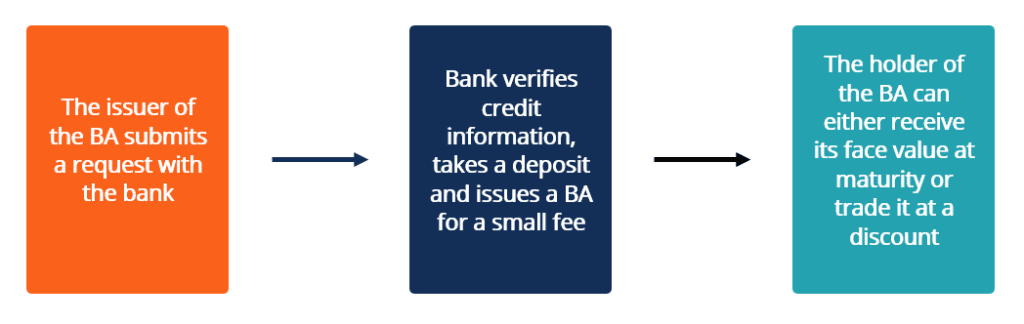

Considered negotiable instruments with features of a time draft bankers acceptances are created by the drawer and provide the bearer with the right to the amount noted on the face of the acceptance on the specified date. A bankers acceptance arises when a bank guarantees or accepts corporate debt usually when it issues a loan to a corporate customer and then sells the debt to investors. It is merely an order by the drawer to the bank to pay a specified sum of money on a specified date to a named person or to the bearer of the draft.

After acceptance the draft becomes an unconditional liability of the bank. Unlike traditional checks bankers. A bankers acceptance is an instrument representing a promised future payment by a bank.

The entry is a debit of 10000 to the cash asset account and a credit of 10000 to the notes payable liability account. The bank would evaluate the credit history of the entity to assess its creditworthiness. The draft specifies the amount of funds the date of the payment and the entity to which the payment is owed.

The drawer of a bankers acceptance should account for the transaction in the same way as for a bill of exchange.

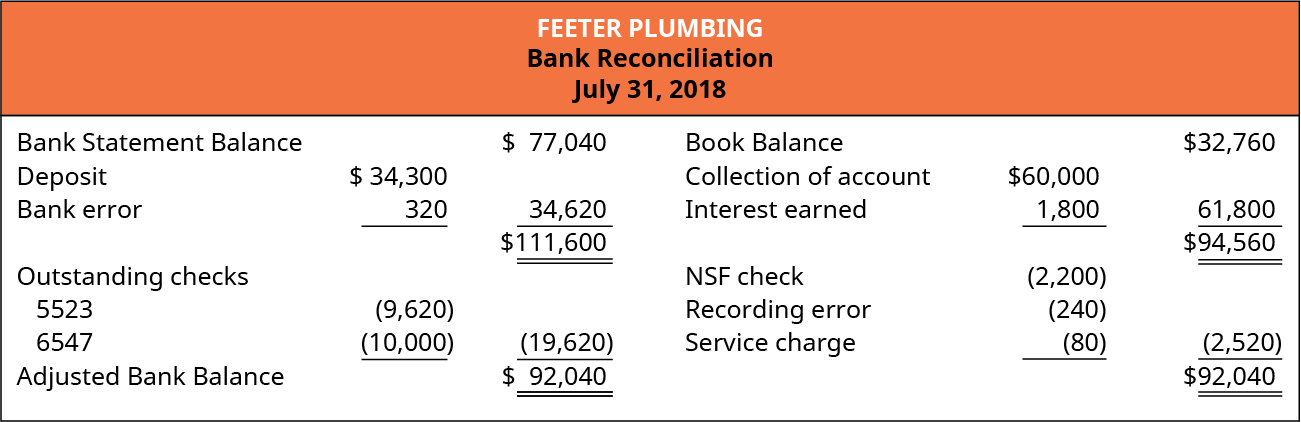

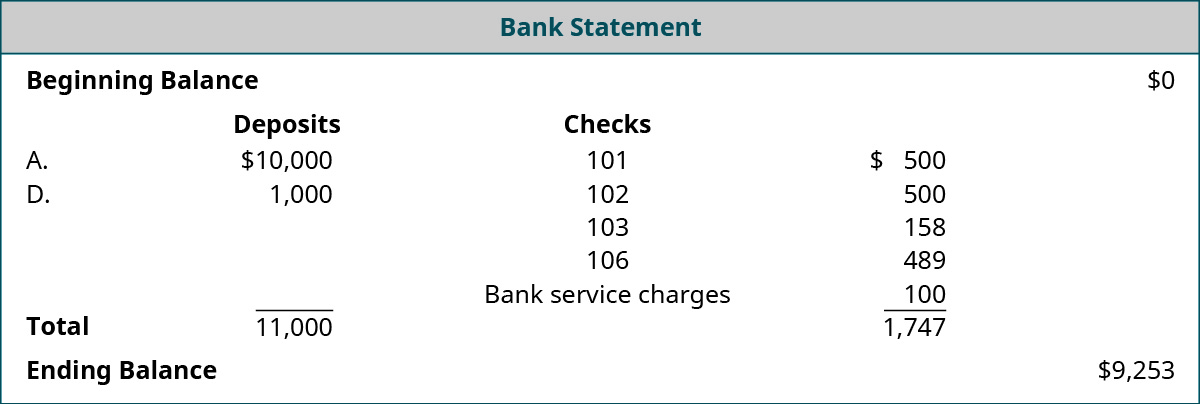

Define The Purpose Of A Bank Reconciliation And Prepare A Bank Reconciliation And Its Associated Journal Entries Principles Of Accounting Volume 1 Financial Accounting

Banker S Acceptance Overview How It Works Investing Tool

Funny Accountant Gifts A Day Wothout Accounting Is Like Sarcasm Coffee Mug For Women Men Tax Accountanting In 2022 Accountant Gifts Funny Accountant Mugs

What Is Double Entry Accounting System Quickbooks

Define The Purpose Of A Bank Reconciliation And Prepare A Bank Reconciliation And Its Associated Journal Entries Principles Of Accounting Volume 1 Financial Accounting

Funny Accountant Gifts A Day Wothout Accounting Is Like Sarcasm Coffee Mug For Women Men Tax Accountanting In 2022 Accountant Gifts Funny Accountant Mugs

Banker S Acceptance Ba Definition

Southbank Centre Spotlight Ident University Project Company Logo Tech Company Logos

Business Math Formulas Speedy Study Guides Ebook By Speedy Publishing Rakuten Kobo Business Writing Skills Math Formulas Studying Math

:max_bytes(150000):strip_icc()/GettyImages-1351380436-3f806ad1e7354802a43abfd60bbad626.jpg)

Banker S Acceptance Ba Definition

Funny Accountant Gifts A Day Wothout Accounting Is Like Sarcasm Coffee Mug For Women Men Tax Accountanting In 2022 Accountant Gifts Funny Accountant Mugs

How To Cold Email For An Internship Templates And Guide

Pin On Usance Letter Of Credit Royal Bank Pacific

/close-up-of-safe-116362698-8291c470571a470195cf330f97659243.jpg)

Banker S Acceptance Ba Definition

Define The Purpose Of A Bank Reconciliation And Prepare A Bank Reconciliation And Its Associated Journal Entries Principles Of Accounting Volume 1 Financial Accounting

Printable Sample Offer Letter Sample Form Jobs For Teachers Letter Templates Free Lettering

Quickstudy Accounting 2 Laminated Study Guide In 2022 Accounting Basics Accounting Bookkeeping Business